How to Use Payment Gateways to Keep Your Business Afloat

Ever found yourself at the register with a customer who’s ready to pay but only has a credit card, not cash? Picture this: a shopper strolls into your store, excited to buy, but you can’t accept cards. ¡Qué pena! You might lose a sale to the shop next door just because your payment options are outdated.

Here’s the deal: if you’re serious about your business, whether it’s a local shop in McAllen or an e-commerce venture, having a robust payment gateway is a must. It’s the technology that helps you accept payments smoothly, whether online or in-person.

What’s a Payment Gateway Anyway?

A payment gateway is like the heavyweight champion of payment processing — the technology that takes card or mobile device info from your customers and sends it to your bank. Think of it as the bridge connecting your customers’ money to your business account. But wait, what about payment processors? While they’re often thrown around together, they’re not the same. A payment gateway collects payment info, while a processor takes care of moving that money around.

So why is this important? Because if you don’t have a payment gateway, your business might as well be handing out "No Sale" signs to customers.

Why You Need One Now More Than Ever

If you’re looking to sell online, a payment gateway is non-negotiable. Picture HubSpot’s One Page Pay as your digital checkout portal — where customers input their card or service provider info like PayPal or Apple Pay to seal the deal.

Seamless Solutions for Local Businesses

In our bustling South Texas economy, every sale counts. A payment gateway allows you to tap into both in-store and online sales, expanding your customer base. Missing out on credit card sales? Ni modo, that’s lost revenue right there.

How Does a Payment Gateway Work?

It’s all about the tech. Here’s a quick overview of how this works during a transaction:

- Customer Input: Your customer enters payment information (like their credit card).

- Verification: The payment gateway checks with the issuing bank if funds are available.

- Encryption: It sends the verified info through secure channels to keep everything hush-hush.

- Authorization: The payment scheme then processes and approves the transaction.

- Completion: Voilà! The money transfers from the customer’s bank to yours.

Real-World Examples of Payment Gateways

You’re probably already familiar with some common payment gateways you can use:

-

PayPal: Popular for its security and versatility.

-

Apple Pay: Known for fast, seamless transactions.

-

Square: Great for in-person interactions.

- Stripe: Offers customization and simplifies the checkout process with features like one-click payments.

Let’s Talk Security

You’re probably wondering: “How safe are these transactions?” A secure payment gateway complies with the Payment Card Industry Data Security Standards. Encryption and tokenization protect sensitive data, making sure all the personal info is secure and cannot be intercepted by others.

Frequently Asked Questions About Payment Gateways

1. What’s the difference between a payment gateway and a payment processor?

A gateway captures and sends payment info to the bank. A processor handles the transaction and moves the money.

2. Why should I use a payment gateway?

Not only does it streamline the payment process, but it also automates data entry, letting you focus on what really matters — growing your business.

3. How can I accommodate various payment options?

Dale gas! Use multiple payment gateways to adapt to your customers’ needs. Research shows that customers abandon their carts if they don’t see their preferred payment methods, so offering options can seriously boost your sales.

4. How much does setting up a payment gateway cost?

Costs vary based on the provider but expect set-up fees, monthly fees, and small transaction fees. Worth it, right?

Wrap-Up

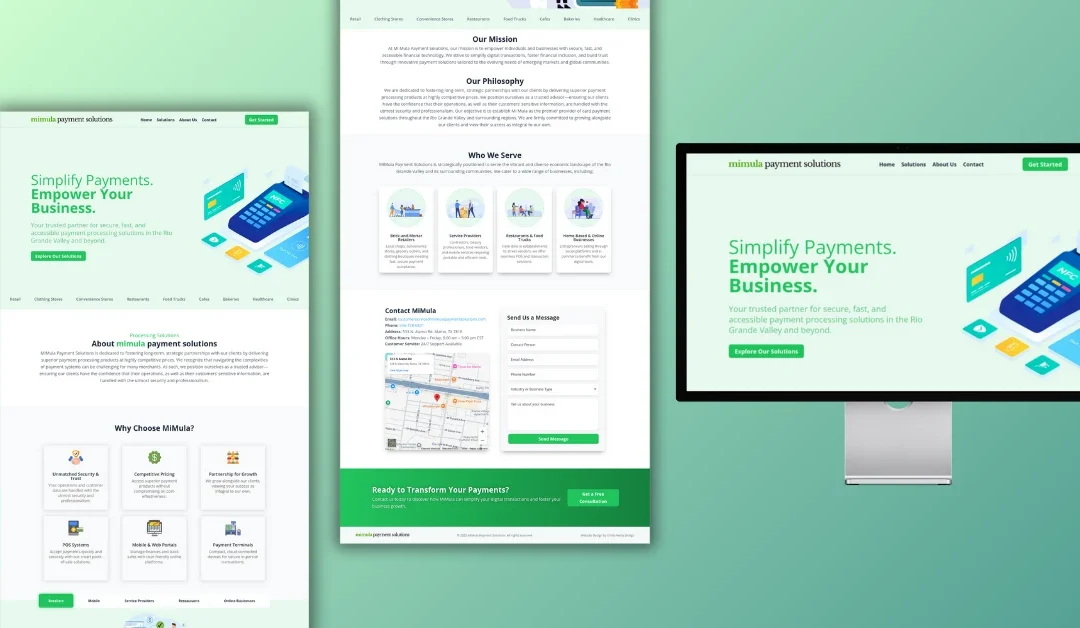

Having a reliable payment gateway isn’t just an "extra" — it’s essential for any business. Whether you’re looking to make sales in McAllen or online, offering seamless payment options can elevate your customer experience and increase your revenue.

If you’re ready to get serious about your payment processes, let’s upgrade your online presence together! At Ericks Web Design, we specialize in creating custom websites that not only shine but help you convert leads into loyal customers.

Ready to take your business to the next level? Schedule a call and let’s build something that actually works for you!