Unlocking Revenue: Why You Need Online Payment Processing

Ever felt like your business is running on empty when it comes to accepting payments? With just 16% of consumers carrying cash nowadays, your online presence is more critical than ever. If you’re not utilizing a payment processor, you might be missing golden opportunities to boost sales. So, let’s dive into what payment processing is all about and why it can be a game-changer for your south Texas business, especially right here in McAllen.

What is Payment Processing?

In simple terms, payment processing refers to companies that operate behind the scenes to facilitate electronic transactions. Think of them as your silent partners, managing the nitty-gritty logistics of moving money from your customers’ accounts to yours. Imagine a customer at your local taco truck — they swipe their card, and voilà! The payment processor makes it all happen, ensuring the transaction is secure and—that cash flow keeps flowing.

The Ins and Outs of Payment Processing

So how does this all work? Let’s break it down:

- A customer makes a purchase, either in-person or online.

- Their card info gets sent securely to the payment processor.

- The processor checks with the bank to ensure there are enough funds.

- Funds are approved or denied, and this info is relayed back to you.

- Finally, the money transfers to your business’ bank account.

Sounds complicated, but you can trust it all happens in seconds—while you enjoy your growing customer base.

Why Should You Care?

Here are a few reasons why having a payment processor can significantly benefit your business:

1. 🚀 Convenience

Make it easy for customers to pay. Less hassle means more sales!

2. ⚡ Speed

Immediate payment processing means funds can show up in your bank fast—ideal for cash flow.

3. 🛡️ Security

Modern payment systems come with encryption and fraud protection—let your customers shop with peace of mind.

4. 📚 Record-Keeping Made Easy

Payment processors often come with tools that let you track sales, manage subscriptions, and automate invoicing.

Cost Considerations

While using a payment processor is beneficial, they come with fees. Here’s a quick rundown of what you may encounter:

- Interchange Fees: These go to the card issuer and are a percentage of each sale.

- Processor Fees: Typically charged per transaction, they vary by provider.

- Merchant Fees: Tied to your bank—these depend on your sales volume.

Think of it like a taco stand—every ingredient costs something. So, if each payment system has its pricing model, it pays to shop around based on your transaction needs.

Exploring the Local Options

Now that you know why you need a payment processor, let’s highlight a few trusted options perfect for our local businesses:

1. HubSpot Payments

Price: Flat 2.9% for credit cards. HubSpot integrates directly with your marketing tools, making it super convenient—no monthly fees!

2. Clover

With an intuitive POS system, Clover handles everything from payments to inventory tracking, perfect for any local eatery looking to streamline sales.

3. PayPal

Price: 3.49% plus $0.49 per transaction. Everybody knows PayPal! They make it easy to set up a secure payment gateway.

4. Stripe

Price: 2.9% plus $0.30. Great for websites with high customization needs—perfect for your web design projects.

5. Square

Another easy-to-use option at 2.9% plus $0.30, particularly beneficial for our brick-and-mortar stores looking to go online too.

Steps to Start Accepting Payments Online

- Set Up a Secure Payment Gateway: Use third-party services if you’re not tech-savvy.

- Facilitate Card Payments: Partner with trusted platforms that accept major cards.

- Consider Recurring Billing: If you have subscriptions, automate those payments.

- Accept Mobile Payments: Everyone has their phone, so leverage that trend now!

- Email Invoicing: Not foolproof but useful for submitting quick payments to clients.

- Consider eChecks: A digitized way to handle payment by check.

- Explore Cryptocurrencies: Get ahead of the curve if you’re tech-savvy!

- Use Payment Links: Shareable payment URLs can expedite checkout—great for social media marketing!

Ready to Boost Your Revenue?

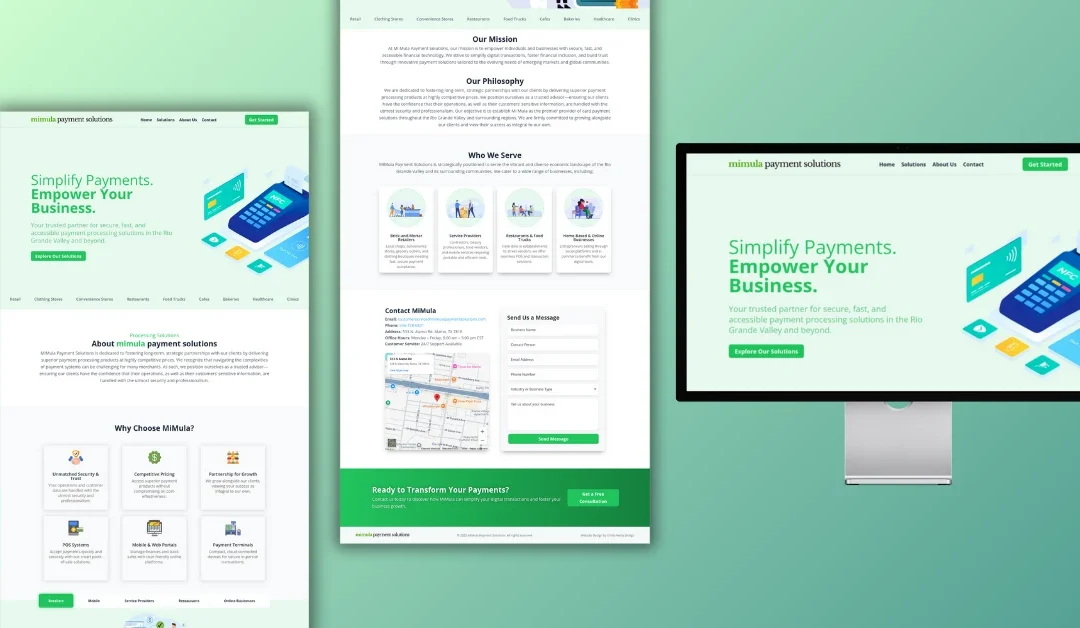

You don’t want to miss out on sales just because your payment options are stuck in the past. At Ericks Web Design, we specialize in crafting beautiful, effective websites that integrate with the best payment processors—trust us to help you get the leads rolling in.

If you need more info or want to discuss your options, let’s chat. Don’t let this opportunity pass you by!

Source:

https://blog.hubspot.com/marketing/receive-payments-online-for-free